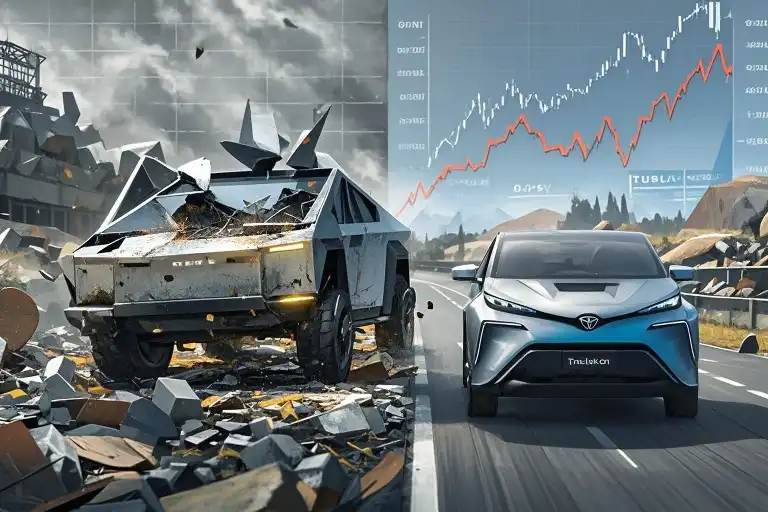

You’ve invested your savings in a company hailed as the “future of transportation.” Its CEO promises self-driving cars, revolutionary batteries, and Mars colonies. Fast forward to 2024, and that same company’s stock is tumbling, its tech promises remain unfulfilled, and its leader… well, let’s just say he’s making more headlines for other reasons.

Welcome to Tesla’s reality check.

This isn’t a sci-fi plot—it’s the story unfolding right now. Let’s grab a coffee, dive into the numbers, and unpack why Tesla’s golden era might be fading faster than a Cybertruck’s novelty.

The Cracks in Tesla’s Armor

1. Products That Lost Their Spark

Remember when Tesla’s Model S felt like driving an iPhone? Today, its lineup feels more like a flip phone in a smartphone world.

- The Cybertruck Curse: Launched with memes and shattered windows, Tesla’s “unbreakable” truck now faces production cuts. Why? Early adopters loved the hype, but mainstream buyers? Not so much. (Think of it as the pet rock of EVs—cool to show off, impractical for daily life.)

- Battery Blues: The 4680 battery was supposed to be a game-changer. Instead, delays and technical hiccups left it outdated before mass production even began. Rivals like CATL? They’re already two generations ahead.

2. Autopilot or Auto-Promise?

Tesla’s “Vision Only” self-driving strategy sounded bold. But here’s the thing: Humans aren’t bats. We can’t navigate by echolocation, and neither can cars.

While Tesla insists cameras beat sensors, competitors like Waymo and Mercedes blend lidar, radar, and cameras. The result? Their systems handle rain, fog, and tricky intersections—things that still stump Tesla’s FSD.

3. The Musk Factor

Let’s be real: Elon Musk is Tesla’s superhero and its kryptonite. His tweets swing stock prices, but his controversies? They’re costing Tesla its “cool kid” reputation.

Example: When Musk endorsed a divisive social media post last year, Tesla’s favorability among liberal-leaning EV buyers (a core demographic) dropped 15% overnight. Ouch.

The Numbers Don’t Lie

Let’s play a quick game. Which company is worth more?

- Company A: Makes $12.6 billion yearly, sells cars, and has a CEO who… let’s say, divides public opinion.

- Company B: Makes $29 billion yearly, sells cars globally, and quietly leads in solid-state battery patents.

If you guessed Tesla (A) over Toyota (B), you’ve nailed Wall Street’s logic—or lack thereof.

| Metric | Tesla (2024) | Toyota (2024) |

|---|---|---|

| Net Income | $12.6 billion | $29 billion |

| Market Value | $852 billion | $243 billion |

| P/E Ratio | 67.65 | 8.40 |

Tesla’s valuation isn’t just high—it’s like paying $100 for a $10 burger because the chef might add truffles someday.

Why Investors Are Hitting the Panic Button

Here’s the domino effect Tesla can’t stop:

- Sales Slump → Fewer car sales mean less cash for R&D.

- R&D Stagnation → Delays in FSD and batteries erode Tesla’s tech edge.

- Tech Erosion → Investors lose faith, selling shares to cut losses.

- Stock Crash → Lower valuation makes it harder to raise funds.

It’s a death spiral. And with Toyota and BYD rolling out affordable EVs with actual self-driving features, Tesla’s “premium” tag looks shaky.

2025: The Year Reality Strikes

If Tesla were valued like a normal car company (P/E ratio of 8-10), its market cap would plummet to $100-$150 billion—a 80%+ drop from today.

But here’s the silver lining: Tesla isn’t doomed yet. To survive, it needs:

- Less Drama, More Cars: Let engineers, not tweets, lead innovation.

- Tech Transparency: Admit FSD’s limitations and collaborate with sensor experts.

- Affordable EVs: The $25k Model 2 isn’t a luxury—it’s a necessity.

Final Thought: A Fork in the Road

Tesla stands at a crossroads. One path leads to becoming the next Apple—a relentless innovator. The other? The next BlackBerry—a pioneer that couldn’t adapt.

As investors, all we can do is ask: Will Tesla’s story be a comeback saga or a cautionary tale? Grab your popcorn—2025 will be the climax.